Understanding profit and loss statements doesn’t require you to be an accountant in Mount Laurel, NJ. You just need a clear guide. Businesses use these statements to track their financial health. Start with the basics. Income is money coming in. Expenses are money going out. The difference is your profit or loss. If you earn more than you spend, that’s a profit. If not, it’s a loss. Such statements help you make smart decisions. They show where you can cut back or invest more.

For beginners, focus on key terms. Revenue means income. Cost of goods sold means the cost to make or buy what you sell. Net income shows your final profit after all expenses. Understanding these terms gives you control and clarity over finances. This knowledge is not just for accountants. Everyone benefits from knowing where their money is going. Your financial success depends on it.

Why Profit and Loss Statements Matter

Profit and loss statements are crucial tools for any business. They provide a snapshot of financial performance over a specific time. This helps you see patterns and trends. You identify strong months and weak months. With this knowledge, you can plan better for the future. It also assists in setting realistic financial goals.

For example, knowing your average monthly profit allows for smarter budgeting. It helps in making decisions about hiring, expansion, or cutting costs. It is an essential aspect of small business management as outlined by the U.S. Small Business Administration.

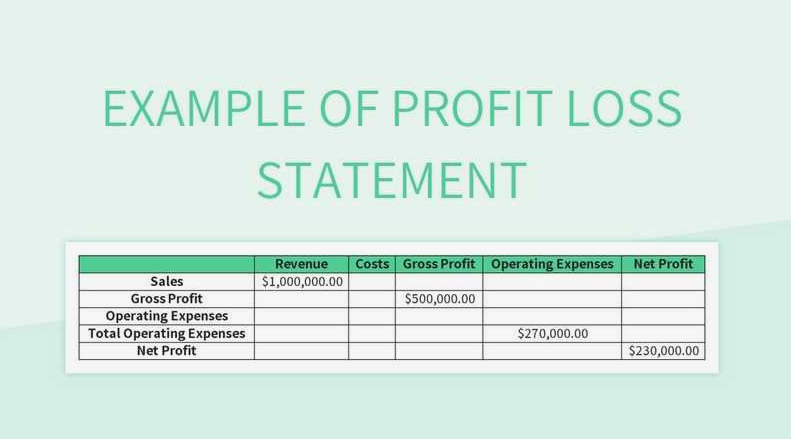

Key Components of a Profit and Loss Statement

A profit and loss statement typically includes several key components. Understanding these components is vital. Let’s break them down:

- Revenue: Total income from sales or services.

- Cost of Goods Sold (COGS): Direct costs related to the production of goods or services.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs not directly tied to production, like rent and utilities.

- Net Income: Gross profit minus operating expenses, taxes, and interest.

Simple Example

Consider a small bakery. Here is a table showing a basic profit and loss analysis:

| Category | Amount ($) |

| Revenue | 10,000 |

| Cost of Goods Sold | 4,000 |

| Gross Profit | 6,000 |

| Operating Expenses | 2,000 |

| Net Income | 4,000 |

This table shows the bakery’s total revenue, cost of goods sold, and the resulting gross profit. After subtracting operating expenses, you find the net income. This is a simple yet powerful way to gauge business health.

Making the Most of Your Statement

Using your profit and loss statement effectively can lead to better decision-making. Here are some tips:

- Review regularly, at least monthly or quarterly.

- Compare periods to spot trends.

- Adjust expenses based on performance.

Understanding these elements equips you to steer your business effectively. It empowers you to make informed decisions to boost profitability and reduce unnecessary costs. Remember, regular review is key to keeping your finances on track. The Federal Reserve also emphasizes the importance of financial statements in tracking business performance.

Conclusion

Mastering profit and loss statements gives you an edge. It helps you understand financial health and make informed choices. This understanding isn’t just for accountants but for anyone wanting to manage finances better. By tracking revenue, expenses, and net income, you gain valuable insights. Always aim to keep learning and improving your financial literacy. This ensures your business stays financially healthy and strong.